When I’m asked about the state of the Australian economy, I turn to my two favourite indicators—the NAB Business Survey and SEEK’s Monthly Employment Report. These sources provide a wealth of data, offering a clear picture of where the economy and labour market are heading. In this article, I’ll share insights from these reports, helping you to decipher the economic signals that matter most for your business strategy in the months ahead.

Optional layout of content:

Overall business conditions in the Australian economy remain below the highs of the COVID period, excluding lockdowns, though overall only slightly below long-term averages. It’s best to compare business performance against the experience of pre-COVID 2019 rather than the unusual peaks of 2021-2023.

Business conditions are currently weakest in Retail, Manufacturing, and Wholesale sectors, driven by high interest rates, consumer spending reductions, and a correction from the strength these sectors saw during COVID. The Mining sector also is experiencing a downturn, reflecting weaker demand from China, and forward orders in each sector indicate further challenges ahead.

Businesses in the services sector—especially Business & Finance, Transport and Infrastructure, and Recreational and Personal Services—are reporting the strongest conditions. This is likely due to the release of pent-up demand, particularly for services like overseas travel that underperformed during COVID.

Victoria and South Australia businesses report the weakest business conditions, contrasting with above-average conditions in Queensland and Tasmania. The other large states are performing around the national average.

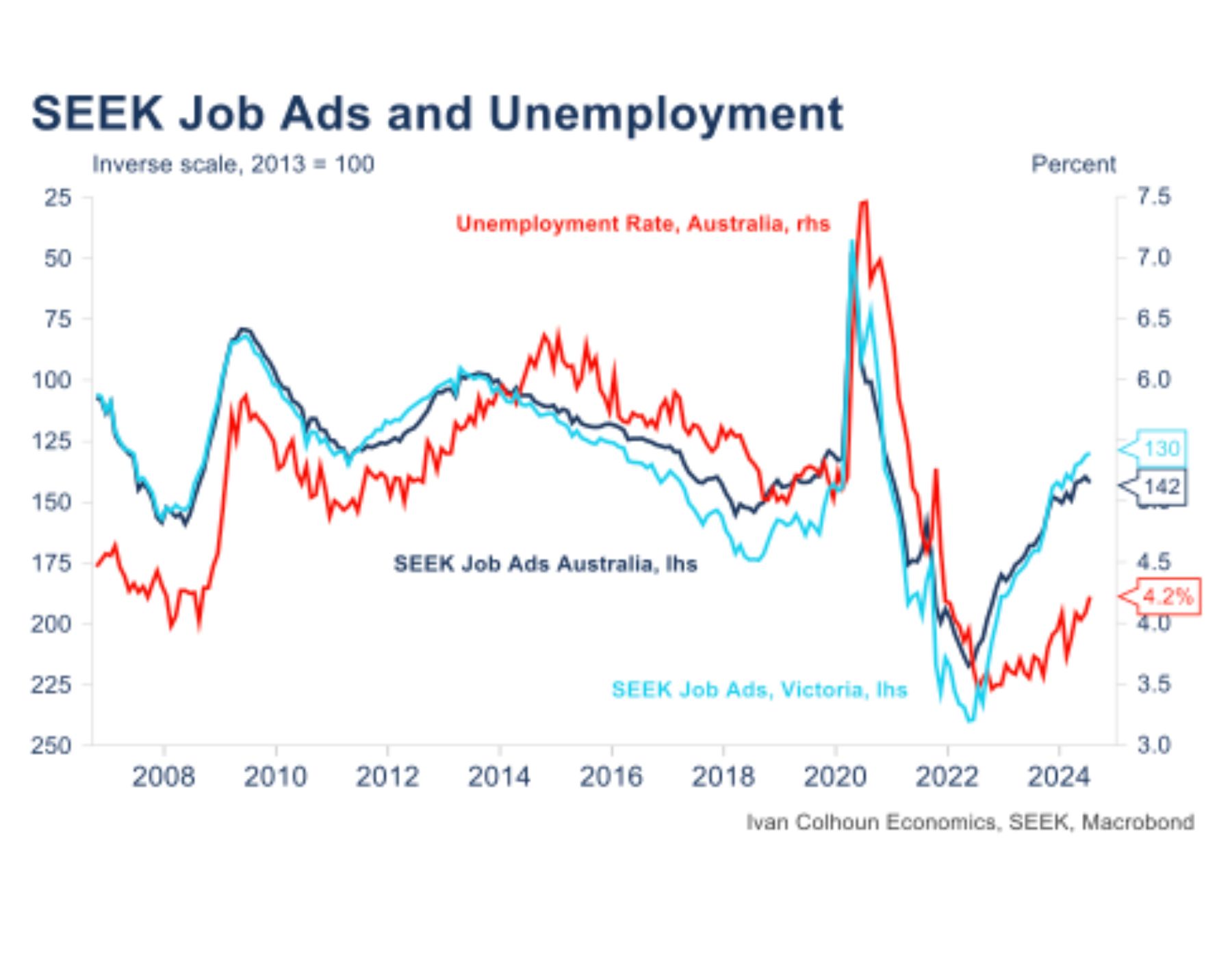

I have always valued job advertising trends as a powerful reflection of broader economic conditions. The financial challenges that businesses face are often most clearly seen in their staffing decisions, and job advertisements provide a real-time snapshot of these shifts. As illustrated in the second chart, the trend in job ads foreshadows movements in the unemployment rate, making it a very reliable indicator of labour market conditions and the broader economy. Interestingly, job ad trends also offer insights into future interest rate developments. It’s important to note that in the chart, job ads are plotted on an inverse scale, highlighting the correlation between declining ads and rising unemployment.

I have always valued job advertising trends as a powerful reflection of broader economic conditions. The financial challenges that businesses face are often most clearly seen in their staffing decisions, and job advertisements provide a real-time snapshot of these shifts. As illustrated in the second chart, the trend in job ads foreshadows movements in the unemployment rate, making it a very reliable indicator of labour market conditions and the broader economy. Interestingly, job ad trends also offer insights into future interest rate developments. It’s important to note that in the chart, job ads are plotted on an inverse scale, highlighting the correlation between declining ads and rising unemployment.

Looking at the SEEK employment report, we can observe the following insights on the labour market:

While job advertising is beginning to slow, the overall level of job advertisements in Australia remains8% above pre-COVID, February 2020 levels. Victoria is lagging behind the national average, with job ads below pre-COVID levels. Both metrics are significantly lower than the exceptional peaks seen during COVID, when unfilled labour demand was at its highest.

The sharp decline in job advertisements from May 2022 to the end of 2023 didn’t trigger the usual spike in unemployment. This anomaly is likely due to an increased supply of labour following the reopening of borders, rather than a reduction in labour demand, which typically is what drives rapid increases in unemployment rates. To an extent, this reflects a correction from the unsustainable extremes of COVID-era job advertising and low unemployment.

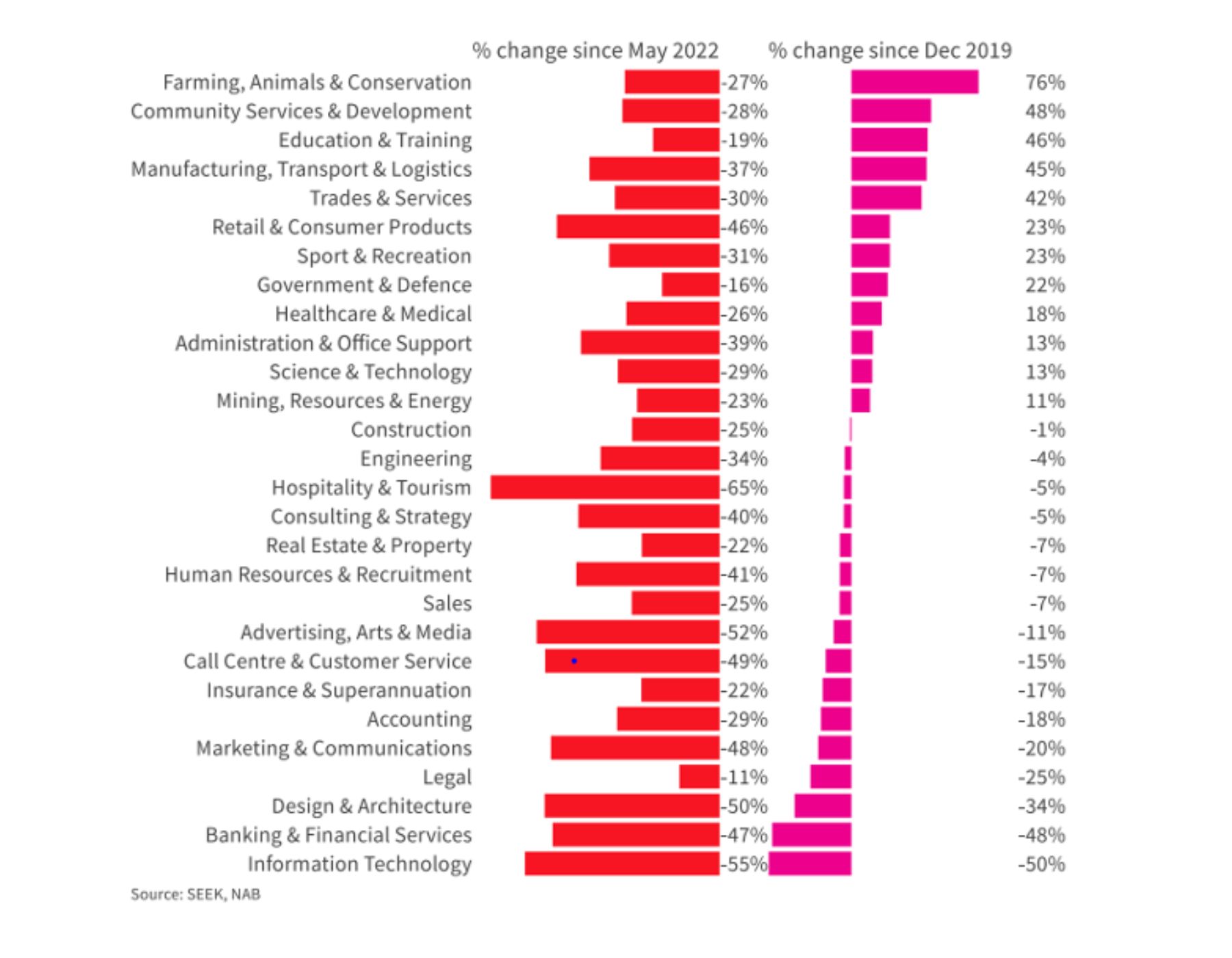

Recent declines in job advertisements now indicate a softening in labour demand, especially within certain white-collar sectors. Banking & Finance, Accounting, Legal, and IT are seeing significantly lower demand compared to pre-COVID levels, reversing the strong demand observed during the pandemic. Conversely, sectors like Community Services, Healthcare and Medical, Government & Defence, and Education & Training, along with Trades & Services and Manufacturing, Transport & Logistics, continue to exhibit strong demand, though again, not at the extremes witnessed during COVID.

Australian businesses are navigating a multifaceted landscape, where high interest rates, post-COVID adjustments, and longer-term challenges including an ageing population, the energy transition, and rapid technological advancements—including AI—converge to create a unique set of economic shocks. In such an environment, it’s crucial for executives and business leaders to avoid extrapolations and comparison with the extraordinary conditions of the COVID years. Grounding performance comparisons with the more stable pre-COVID period likely offers a clearer, more accurate picture of current economic health.

As we move forward, signs of a cooling labour market and moderating inflation suggest that some interest rate relief may be on the horizon. The Reserve Bank of Australia is expected to follow the lead of other central banks by cautiously reducing interest rates, in the first half of 2025. This anticipated shift will be a critical factor in shaping the next phase of Australia’s economic journey.

Ivan Colhoun brings a wealth of experience and expertise to his analysis of the Australian economy and labour markets. As a highly regarded Chief Economist with a proven track record across various industries, Ivan has become a trusted advisor to businesses ranging from small enterprises to multinational corporations. His ability to simplify complex economic concepts and his deep understanding of monetary policy, interest rates, and industry-specific trends make his insights invaluable to business leaders navigating today’s dynamic economic environment. Ivan’s extensive experience, including his roles as Chief Economist for NAB’s Corporate & Institutional Banking division, and his prior leadership positions in major financial institutions, underscores his authority on economic matters, making him an indispensable resource for those seeking to understand and respond to the forces shaping the Australian economy. He is available for consulting projects, and as a keynote speaker for Board and Management meetings or offsites and customer functions.